9 Easy Facts About Tulsa Bankruptcy Attorney Explained

9 Easy Facts About Tulsa Bankruptcy Attorney Explained

Blog Article

Tulsa Ok Bankruptcy Attorney for Beginners

Table of ContentsTulsa Bankruptcy Lawyer Fundamentals ExplainedIndicators on Tulsa Bankruptcy Legal Services You Need To Know5 Easy Facts About Tulsa Ok Bankruptcy Specialist DescribedThe smart Trick of Chapter 13 Bankruptcy Lawyer Tulsa That Nobody is DiscussingExamine This Report on Bankruptcy Attorney Tulsa

The stats for the other primary kind, Chapter 13, are even worse for pro se filers. Suffice it to say, speak with a legal representative or two near you that's experienced with bankruptcy legislation.Numerous attorneys likewise supply free assessments or email Q&A s. Take benefit of that. Ask them if personal bankruptcy is indeed the ideal choice for your circumstance and whether they believe you'll qualify.

Advertisement Now that you have actually decided personal bankruptcy is undoubtedly the best program of activity and you with any luck removed it with an attorney you'll need to obtain begun on the paperwork. Prior to you dive into all the official bankruptcy kinds, you need to obtain your very own files in order.

The smart Trick of Bankruptcy Attorney Near Me Tulsa That Nobody is Talking About

Later on down the line, you'll actually need to prove that by disclosing all type of information regarding your monetary affairs. Below's a standard checklist of what you'll need when driving in advance: Recognizing files like your chauffeur's certificate and Social Safety and security card Income tax return (approximately the past four years) Proof of income (pay stubs, W-2s, freelance earnings, earnings from assets along with any type of earnings from federal government benefits) Bank statements and/or retired life account statements Evidence of value of your possessions, such as car and property appraisal.

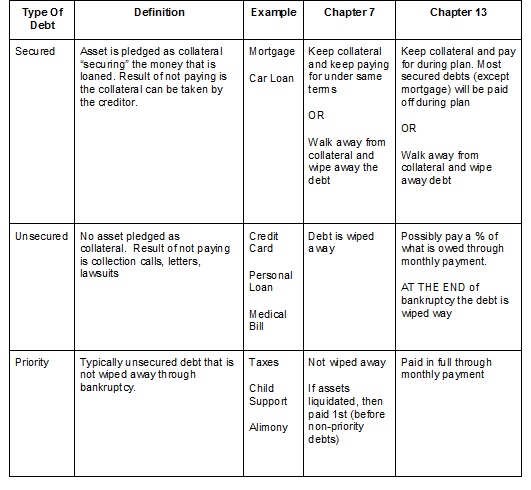

You'll wish to comprehend what type of financial obligation you're trying to deal with. Debts like child assistance, spousal support and certain tax financial obligations can't be released (and personal bankruptcy can not stop wage garnishment pertaining to those financial debts). Pupil lending financial obligation, on the other hand, is possible to release, however note that it is difficult to do so (Tulsa OK bankruptcy attorney).

You'll wish to comprehend what type of financial obligation you're trying to deal with. Debts like child assistance, spousal support and certain tax financial obligations can't be released (and personal bankruptcy can not stop wage garnishment pertaining to those financial debts). Pupil lending financial obligation, on the other hand, is possible to release, however note that it is difficult to do so (Tulsa OK bankruptcy attorney).If your revenue is as well high, you have an additional choice: Chapter 13. This alternative takes longer to solve your financial obligations since it requires a long-term payment strategy normally three to five years prior to several of your staying debts are cleaned away. The filing procedure is also a great deal a lot more intricate than Chapter 7.

The Greatest Guide To Which Type Of Bankruptcy Should You File

A Chapter 7 personal bankruptcy remains on your credit history report for 10 years, whereas a Chapter 13 bankruptcy falls off after 7. Both have lasting impacts on your credit rating rating, and any type of new debt you secure will likely come with greater rate of interest rates. Prior to you send your personal bankruptcy types, you must first complete a necessary program from a credit therapy agency that has actually been authorized by the Department of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The course can be completed online, in individual or over the phone. You need to finish the training course within 180 days of declaring for insolvency.

Top-rated Bankruptcy Attorney Tulsa Ok Can Be Fun For Everyone

Examine that you're filing with the proper one based on where you live. If your permanent home has actually moved within 180 days of loading, you ought to file in the district where you lived the higher part of that 180-day period.

Commonly, your insolvency attorney will certainly work with the trustee, yet you might require to send the person papers such as pay stubs, tax obligation returns, and savings account and charge card declarations straight. The trustee that was simply designated to your instance will quickly set up an obligatory conference with you, referred to as the "341 meeting" due to the fact that it's a need of Section 341 of the united state

You will certainly require to provide a prompt checklist of what certifies as an exemption. Exemptions may relate to non-luxury, primary cars; needed home items; and home equity (though these exceptions policies can vary commonly by state). Any type of residential property outside the listing of exceptions is thought about nonexempt, and if you don't provide content any checklist, after that all your residential property is thought about nonexempt, i.e.

You will certainly require to provide a prompt checklist of what certifies as an exemption. Exemptions may relate to non-luxury, primary cars; needed home items; and home equity (though these exceptions policies can vary commonly by state). Any type of residential property outside the listing of exceptions is thought about nonexempt, and if you don't provide content any checklist, after that all your residential property is thought about nonexempt, i.e.The trustee would not offer your cars to promptly repay the lender. Instead, you would certainly pay your financial institutions that amount throughout your layaway plan. A typical mistaken belief with bankruptcy is that when you file, you can stop paying your financial debts. While personal bankruptcy can help you eliminate a lot of your unsecured debts, such as past due medical expenses or personal loans, you'll desire to keep paying your month-to-month settlements for safe debts if you intend to keep the building.

Getting The Tulsa Bankruptcy Consultation To Work

If you're at danger of repossession and have actually tired all other financial-relief alternatives, after that applying for Chapter 13 may delay the repossession and conserve your home. Eventually, you will certainly still need the income to continue making future home loan payments, in addition to paying back any kind of late repayments over the program of your layaway plan.

If so, you might be needed to give additional information. The audit can delay any kind of over here financial debt relief by a number of weeks. Of course, if the audit transforms up incorrect information, your instance could be dismissed. All that said, these are fairly unusual instances. That you made it this far in the process is a decent sign a minimum of a few of your debts are eligible for discharge.

Report this page